charitable gift annuity tax reporting

A charitable lead trust pays an annuity or unitrust interest to a designated charity for a specified term of years the charitable term with the remainder ultimately distributed to non-charitable beneficiaries. Taxable gift of 0 Jane owed no gift tax and did not need to use any of her available gift tax exemption.

How Do I Deduct A Gift Annuity To A Charity

The Baltimore Raven Says Nevermore.

. Form 4808 Computation of Credit for Gift Tax. You may receive a Form 1099-B reporting the sales proceeds. At the end of 10 years the remaining CLAT assets totaling 1947000 are distributed to Janes descendants.

Protection product guarantee provider. Reporting and resolving your tax-related identity theft issues. The methods for calculating a charitable remainder annnuity trust and a charitable remainder unitrust are different because the CRUT income stream fluctuates with changes in the value of the trust property.

You may be able to deduct this gift as a charitable contribution on next years tax return if you itemize your deductions. The 25 Most Influential New Voices of Money. Examinations Appeals Collections and Refunds.

Financial and Estate Planning. Or charitable gift annuity. The technicalities involved in determining the value of the income stream or the remainder interest are much more complex for a CRUT.

Such purposes include general support for. Form 712 Life Insurance Statement. Estate and Generation-Skipping Transfer Taxes.

Charitable Gift Annuity Application Packet ONLINE Charitable Gift Annuity Issuer Annual Report Form. A GRAT is generally used to transfer rapidly appreciating or high income-producing property to heirs with the main goal of transferring free of federal gift tax a portion of any appreciation in or income earned by the trust property during the annuity period. Qualified charitable distributions QCDs may be reduced.

Explore the list and hear their stories. Independent review reporting for independent review organizations IROs. Management of a Gift Planning Program.

170A-15 through 17 taxpayers may discover their donations to charity may not qualify for an income tax deduction. Your Rights as a Taxpayer. Syllabus for Gift Planners section 2.

Form 709 United States Gift and Generation-Skipping Transfer Tax Return. Syllabus for Gift Planners section 2. Tax Preparation Service Company Bond.

1458 contains the factors for valuing the remainder interest in a charitable. Learn more about how to make a qualified charitable distribution now. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of.

Any other tax-free payment other than a gift or inheritance received as educational assistance. A tax-sheltered annuity plan section 403b plan. Risk retention and purchasing groups.

For more information about basis. If you acquired the property by gift by inheritance or in some way other than buying it you must use a basis other than its cost. Including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in the trust.

Certain state and local taxes including tax on gasoline car inspection fees assessments for sidewalks or other improvements to your property tax you paid for someone else and license fees for example marriage drivers and pet. Instructions and Packet pdf Instructions and Packet word. Syllabus for Gift Planners section 5.

Ways to check on the status of your refund. If youre a participant in a tax-sheltered annuity plan section 403b plan the limit on elective deferrals for 2021 is generally 19500. For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes.

115-97 and recent final regulations issued on charitable gift substantiation Regs. More than one business. Health Carrier Grievance Reporting Forms and Procedures.

However many of these crowdfunding websites are not run by DGRs. Charitable Trusts Charitable Lead Trust. Beginning in tax years after December 31 2019 your maximum annual exclusion for QCDs may require an additional adjustment.

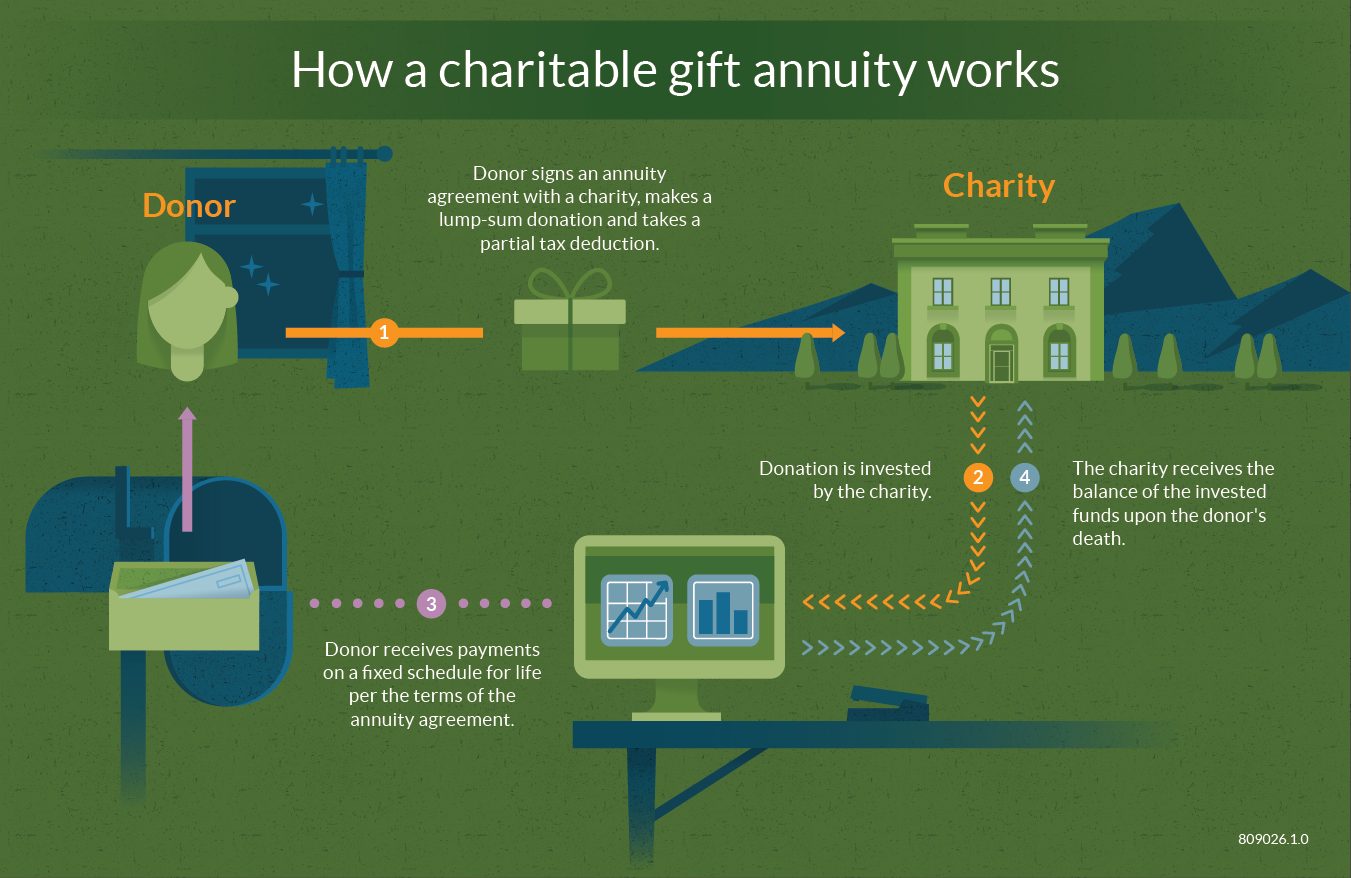

Tax Preparation Service Companies. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. D Exception for certain annuity contracts If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined in section 501m and such organization purchases any annuity contract to fund such obligation persons receiving.

With these new stringent regulations it is. However see Line 16 later if you had income in respect of a decedent. Final regulations provide that the requirement to report contributor names and addresses on annual returns generally applies only to returns filed by Section.

Your guide to the future of financial advice and connection. Court awards and damages. Pension and Annuity Income.

For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev. Form 2848 Power of Attorney and Declaration of Representative. Federal estate and gift taxes.

Specialized Trusts are only part of Regions comprehensive wealth planning. The United States of America has separate federal state and local governments with taxes imposed at each of these levels. This is effected under Palestinian ownership and in accordance with the best European and international standards.

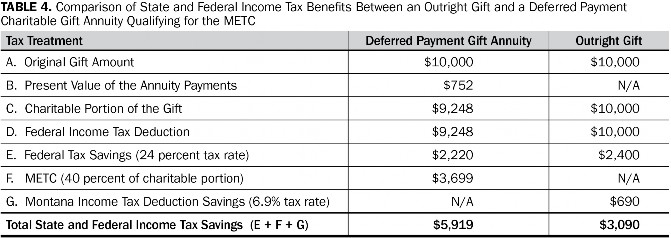

Not all charities are DGRs. Gift tax charitable deduction. For example if you have 25000 in taxable income this year and donate 60 of that or 15000 to charity you will receive the deduction for the whole gift and what you save on taxes lowers.

At the time of the gift the promoter was selling similar lots of bibles for either 10000 or 30000. Syllabus for Gift Planners section 4. You can donate up to 100000 per tax year directly from an IRA to save lives.

A QCD can be made to your sponsoring 501c3 organization if there are programs that you can fund outside of your DAF. For federal tax purposes this trust is treated as a grantor trust. 1457 also contains actuarial factors for computing the value of a remainder interest in a charitable remainder annuity trust and a pooled income fund.

The surprising truth about content. 551 Basis of Assets. Creative Advanced Gift Annuity Planning.

Form 4768 Application for Extension of Time To File a Return andor Pay US. File amend and view premium taxes. Lexis has the largest collection of case law statutes and regulations Plus 40K news sources 83B Public Records 700M company profiles and documents and an extensive list of exclusives across all.

In light of the new rules enacted by the law known as the Tax Cuts and Jobs Act PL. Form 1024-A Application for Recognition of Exemption Under Section 501c4 must be submitted electronically on Paygov. Reporting of donor information Form 990 990-EZ and 990-PF.

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts or donations.

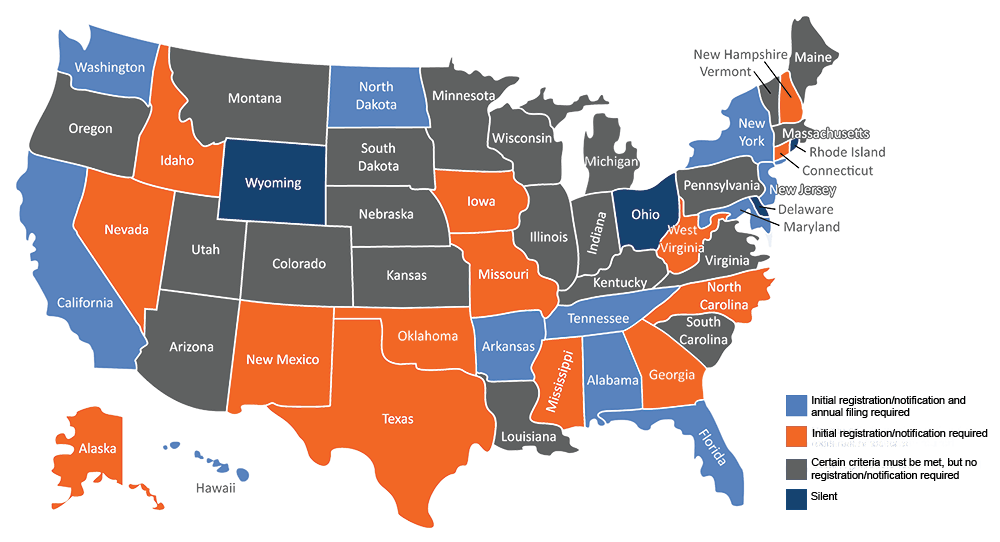

Charitable Gift Annuities Uses Selling Regulations

Gift Annuity State Registration Crescendo Interactive

Charitable Gift Annuity Priests Matching Program Catholic Extension

Charitable Gift Annuity Licensing Compliance In Illinois Harbor Compliance

The Pros And Cons Of Charitable Gift Annuities

Charitable Gift Annuities Everence Faith Based Financial Services

Charitable Gift Annuity Claremont Mckenna College

What Is A Charitable Gift Annuity Fidelity Charitable

Charitable Gift Annuity Planned Parenthood

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Everything You Need To Know About A Charitable Gift Annuity Due

What Is A Charitable Gift Annuity Thrivent

Msu Extension Montana State University

Charitable Gift Annuity St Paul The Apostle Catholic Church Chino Hills Ca

Planned Giving 101 Charitable Gift Annuities Agfinancial

Charitable Gift Annuities Kqed

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm